How to Fill a Cheque: Cheques have long been a reliable and widely used way of making payments. While digital payment methods have gained popularity in recent years, cheques still hold their place in various financial activities. Whether you’re paying a bill, making a gift, or conducting any other form of monetary exchange, knowing how to properly fill out a cheque is important. In this piece, we will walk you through the process step by step, ensuring that you can confidently and accurately fill out a cheque when needed.

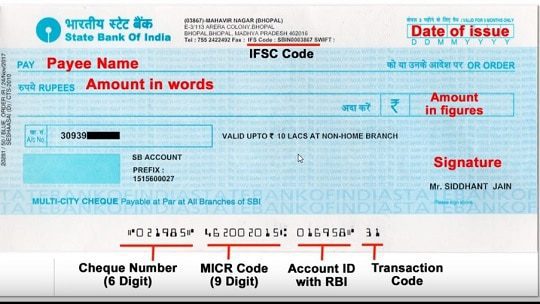

Understanding the Parts of a Cheque

Before we delve into the steps of filling out a cheque, let’s familiarize ourselves with the different parts of a normal cheque. This will help ensure that you understand what each section means and how it contributes to the overall payment process.

Header section: Located at the top of the cheque, this area usually includes the bank’s logo, name, and address.

Payee line: This is where you write the name of the person or group to whom you are making the payment.

Amount line: In this part, you will write the payment amount both in words and numbers.

Signature line: Your signature is needed to authorize the payment.

Memo line: This optional section allows you to include a note or reminder regarding the reason of the payment.

Now that we have a clear idea of the different parts of a cheque, let’s proceed with the step-by-step guide on how to fill it out correctly.

Step-by-Step Guide to Filling a Cheque

Date: Start by writing the date on the line given. Ensure that the date is correct and up to date.

Payee name: Write the name of the person or group you wish to pay on the payee line. Make sure to use their full and correct name.

Amount in words: On the line below the payee line, write the payment amount in words. For example, if you are paying $150, write “One hundred fifty dollars” or “One hundred fifty only.” This helps avoid any confusion or alteration of the payment amount.

Amount in numbers: In the box on the right-hand side of the cheque, write the cash amount in numbers. Make sure to be exact and avoid any discrepancies between the written and numerical amounts.

Signature: Sign the cheque on the designated line to approve the payment. Use your regular signature and ensure it fits the signature on file with your bank.

Memo (optional): If you want to provide extra information about the payment, you can use the memo line. This can be useful for noting invoice numbers, account references, or other important details.

It’s important to follow these steps carefully to ensure that your cheque is filled out correctly. However, there are a few usual mistakes to avoid when writing a cheque.

Common Mistakes to Avoid

Illegible writing: Write clearly and legibly to avoid any misunderstanding or misinterpretation of the information. Illegible handwriting can lead to payment delays or mistakes.

Overwriting or changes: Do not overwrite or make alterations on a cheque. If you make a mistake, it’s best to cancel the cheque and start over with a new one.

Missing signature: Always remember to sign the cheque. Without a legal signature, the cheque may be considered invalid or may not be accepted by the payee’s bank.

Now that we’ve covered the important steps and common mistakes, let’s explore some tips to help you write a legible cheque.

Tips for Writing a Legible Cheque

Use capital letters: Writing in capital letters can improve the legibility of your cheque. It decreases the chances of misinterpretation and ensures that all characters are clear.

Leave space between words and digits: Maintain sufficient spacing between words and numbers to avoid any confusion. This helps in distinguishing the payment amount in words from the numerical version.

Avoid abbreviations: Write out the complete names of people or organizations instead of using abbreviations. This reduces the chance of errors or misunderstandings.

Following these tips will help you write a clear and error-free cheque. However, it’s also important to take safety steps to protect your cheques and ensure their secure usage.

Safety Measures to Protect Your Cheques

Keep your checks secure: Store your cheques in a safe and secure place, such as a locked drawer or a secure home safe. Avoid leaving blank cheques in easily accessible places.

Monitor your bank statements: Regularly review your bank statements to ensure that all the cheques you’ve made are accounted for. If you notice any discrepancies or unauthorized transactions, report them to your bank instantly.

While traditional cheque-writing methods are still widely used, technological advances have introduced alternatives to consider.

Alternatives to Cheques

As the world becomes more digitally oriented, several alternatives to cheques have appeared. These alternatives offer convenience, speed, and improved security. Consider the following options:

Online banking transfers: Online banking allows you to transfer funds straight from your account to the payee’s account using electronic methods. It offers a quick and efficient way to make payments without the need for physical cheques.

Mobile payment apps: Mobile payment apps, such as PayPal, Venmo, and Apple Pay, have gained popularity as convenient ways to give and receive money. These apps allow you to make payments using your smartphone, eliminating the need for paper cheques altogether.

While cheques still have their place, considering these alternatives can provide you with more flexibility and efficiency in handling your payments.

Conclusion

Knowing how to fill out a cheque accurately is a useful skill in today’s financial landscape. By following the step-by-step guide and avoiding common mistakes, you can confidently and correctly write cheques for different transactions. Remember to prioritize legibility, protect the security of your cheques, and consider alternative payment methods when suitable.

If you have any further questions or concerns regarding cheque writing or financial transactions, please return to the FAQs below.

FAQs

What happens if I make a mistake while writing a cheque?

If you make a mistake, it’s best to cancel the cheque and start over with a new one to ensure accuracy and avoid confusion.

Can I post-date a cheque?

Yes, you can post-date a cheque by putting a future date on it. However, keep in mind that the payee may not be able to cash it until the stated date.

How long does it take for a cheque to clear?

The time it takes for a cheque to clear can vary based on various factors, including the banks involved. Generally, it takes a few business days for the funds to be available in the payee’s account.

What should I do if my cheque gets lost or stolen?

If your cheque gets lost or stolen, call your bank immediately to report the incident. They will guide you on the necessary steps to protect your account and avoid any unauthorized transactions.

Are there any fees associated with using cheques?

Some banks may charge fees for certain cheque-related services, such as ordering chequebooks or stopping payment on a cheque. It’s advisable to check with your bank to understand their unique fee structure.

Thank you for reading this thorough guide on how to fill out a cheque. We hope you found it informative and helpful in your financial efforts.